JULY & AUGUST 2024 ISSUE

Cover Story

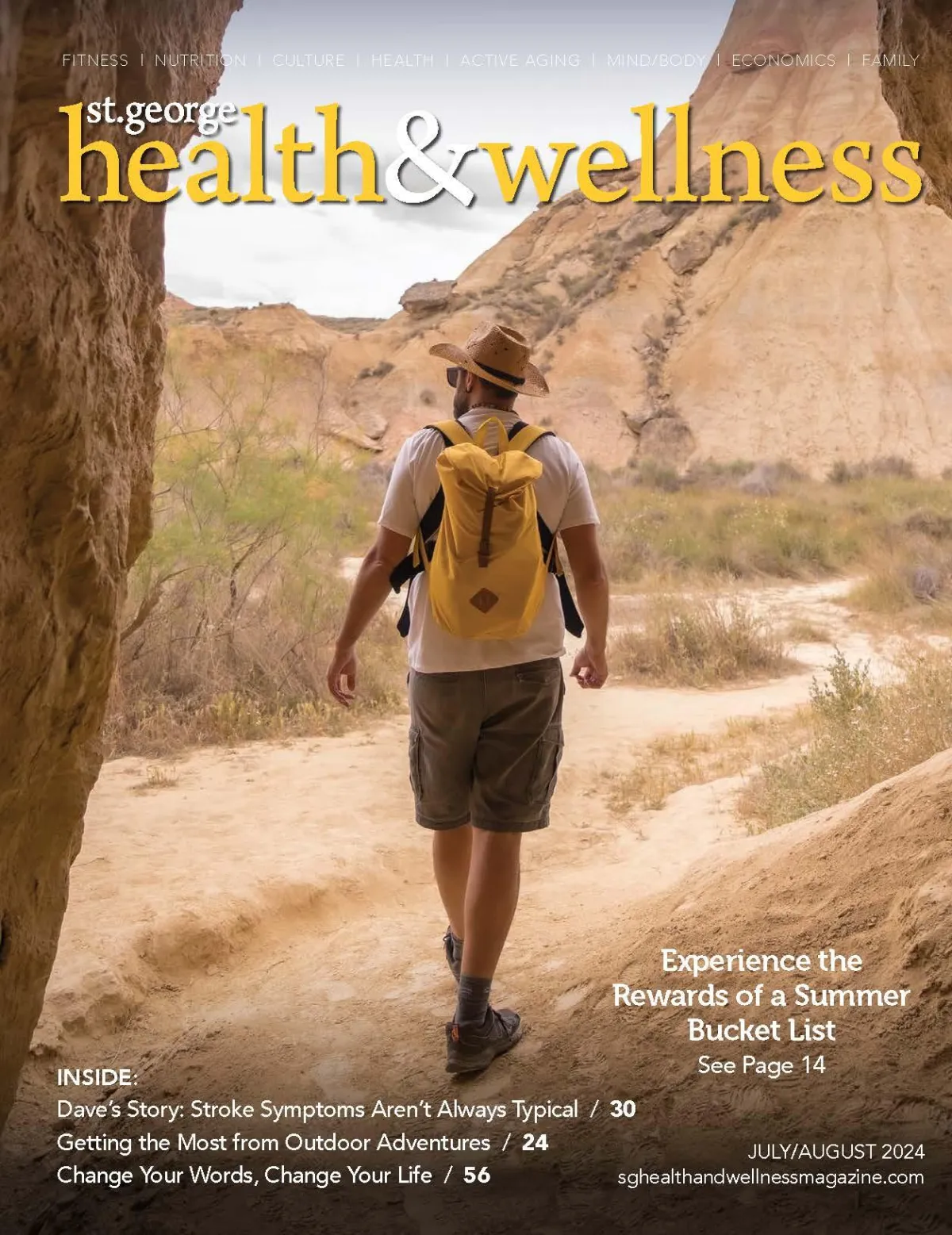

Experience the Rewards of a Summer Bucket List

Community & Culture

Letter from the Editor

Mayor’s Message

Trailblazer Nation

Start on Your Path to a Stable Career

Navigating Real Estate in the Age of the Internet

The Health Benefits of Resort Living: Why Resort Residences Are the Ultimate Wellness Retreat

Utah Tech University Debuting the State’s Most Affordable Online Master of Healthcare Administration Program

Creative Wigs and Hair Replacement Now Celebrating Sixty Years of Service

It Takes Little to Be a Big

Carsen Cooper: Lessons I Learned at Boy’s Nation

Health & Fitness

Flex-Time: Trish Schlegel Is Ageless Bodybuilder

Walk Your Way to a Longer, Healthier Life

Getting the Most from Outdoor Adventures

Menopause and Obesity: a Real Phenomenon

Riding on the Wind

Dave’s Story: Stroke Symptoms Aren’t Always Typical

The American Apple

Ease the Ache: Arthritis Care and Advice from Vista Healthcare

Alternative Holistic Care for Horses

Preventive Dental Care Will Help You Live Your Best Life

Utah’s Swell: Utah Is Great, but It Is Also Home to the San Rafael Swell

Four Considerations for Effective Tax Planning in Retirement

A Look at Self-Guided In-Home Health Tests

Empower Yourself with Nutrition Know-How

Four Tips for Summer Water Safety

Mind & Body

Experience the Rewards of a Summer Bucket List

The Mental Health Benefits of Exercise for Older Adults

The Profound Relationship between Our Physical and Emotional Health

Nurtured by Nature: Interacting with Nature Benefits the Body and Mind

Change Your Words, Change Your Life

Set Your Sights Higher with a Vision Board

What Type of Ketamine Is Right for You?

Relationships & Family

Have You Lost That Loving Feeling?

Encounter on Santa Clara Boulevard

Who Am I? A Map to Self-Discovery

Make a Positive Impact by Planting a Tree

Current Articles

Insurance Is Essential for Your Business

Insurance is one of the smartest investments a business owner can make, providing a solid foundation of security and resilience. While some may view insurance as an optional expense, the reality is that companies with insurance fare far better in the face of unexpected setbacks than those without it. Here is why having insurance—ranging from business to home, general liability, auto, and workers’ compensation—is invaluable.

From fires to natural disasters, unexpected events can cause serious financial strain. For businesses with comprehensive property and general liability insurance, these events don’t mean disaster. Business and property insurance covers the costs of repairs, the replacement of damaged goods, and even the lost income from business interruptions so that cash flow remains stable and operations can resume as quickly as possible. Without these coverages, the financial burden can be overwhelming, often leaving a business to close or to struggle for years to get back to normal operations.

Workers’ compensation insurance ensures that employees are protected if they get injured on the job, covering medical expenses and lost wages. For businesses without this critical coverage, an employee injury can lead to steep medical bills, lawsuits, and a loss of trust. Workers’ comp not only safeguards your workforce but also fosters loyalty and morale, demonstrating that you prioritize employee well-being.

If your business relies on vehicles, commercial auto insurance is equally essential. Commercial auto policies provide coverage for company vehicles, ensuring that accidents, theft, and vehicle damage don’t derail your operations. Residential and personal auto insurance are just as important outside the business realm, protecting both personal assets and peace of mind.

Insurance provides confidence to clients, partners, and employees alike. With these coverages in place, businesses are seen as stable, prepared, and trustworthy, especially in today’s uncertain world. Investing in business, residential, general liability, workers’ comp, and commercial auto insurance sends a clear message that you’re committed to protecting your operations, people, and all stakeholders involved.

Choosing not to have insurance is a gamble—one that risks everything you’ve worked hard to build. With insurance, you’re not just protecting assets, you’re investing in your company’s future, its people, and its continued growth. In the end, the peace of mind that insurance provides is invaluable and can be the difference between bouncing back from a setback or facing long-term consequences.

Emma, the owner of a thriving coffee shop, learned the importance of business liability insurance when a customer slipped on her wet floor and filed a lawsuit for medical expenses and lost wages. Despite having a warning sign in place, the incident threatened to drain her savings and jeopardize her business. Thankfully, her liability insurance covered the costs, allowing her to handle the situation without financial ruin. This experience taught Emma that liability insurance isn't just a safety net, it's a vital shield that protects businesses from unexpected setbacks and ensures they can survive unforeseen challenges.

Riverside Business Insurance Agency can provide a safety net for your business. For more information, call 435-628-8738 or visit their website at stgeorgeinsurance.com.